How San Diego Home Insurance can Save You Time, Stress, and Money.

How San Diego Home Insurance can Save You Time, Stress, and Money.

Blog Article

Secure Your Tranquility of Mind With Reliable Home Insurance Plan

Why Home Insurance Policy Is Vital

The relevance of home insurance depends on its capability to offer monetary security and comfort to house owners when faced with unforeseen events. Home insurance policy serves as a safety web, providing protection for problems to the physical structure of the residence, individual items, and obligation for crashes that might occur on the residential property. In the event of all-natural disasters such as fires, floods, or earthquakes, having a comprehensive home insurance plan can aid home owners restore and recoup without dealing with substantial monetary worries.

Furthermore, home insurance coverage is frequently required by home loan loan providers to protect their financial investment in the home. Lenders want to guarantee that their monetary passions are safeguarded in instance of any damage to the home. By having a home insurance plan in location, property owners can fulfill this demand and safeguard their investment in the building.

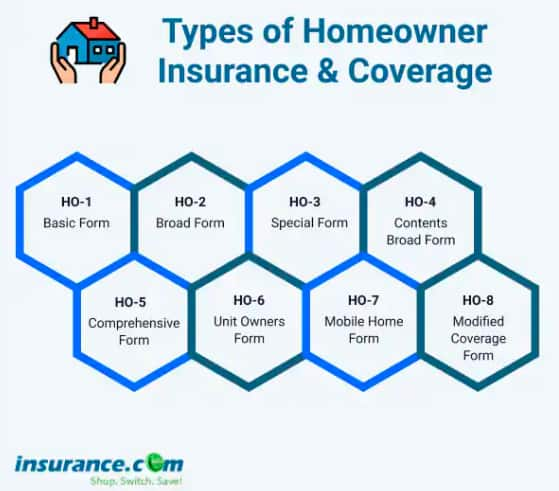

Kinds Of Insurance Coverage Available

Provided the value of home insurance in shielding house owners from unexpected economic losses, it is important to recognize the numerous types of protection readily available to tailor a policy that fits individual needs and situations. There are several vital kinds of insurance coverage used by the majority of home insurance policy policies. Individual property insurance coverage, on the various other hand, safeguards personal belongings within the home, consisting of furniture, electronics, and clothing.

Aspects That Influence Premiums

Variables affecting home insurance premiums can differ based upon an array of factors to consider specific to private circumstances. One significant aspect impacting premiums is the location of the insured residential or commercial property. Houses in locations prone to all-natural disasters such as wildfires, earthquakes, or storms normally draw in greater premiums as a result of the enhanced risk of damages. The age and problem of the home also play a crucial role. Older homes or buildings with obsolete electric, plumbing, or heater may present higher risks for insurance provider, bring about greater premiums.

Furthermore, the protection limitations and deductibles selected by the insurance policy holder can impact the costs quantity. Choosing greater protection limits or reduced deductibles typically leads to greater costs. The sort of building and construction products used in the home, such as wood versus brick, can likewise impact costs as particular products might be extra at risk to damages.

Exactly How to Pick the Right Plan

Choosing the ideal home insurance plan involves cautious consideration of various crucial elements to make certain comprehensive protection customized to specific demands and situations. To begin, examine the worth of your home and its materials accurately. Next, take into consideration the various types of insurance coverage offered, such as home insurance coverage, individual property protection, obligation protection, and extra living costs coverage.

Additionally, evaluating the insurance policy company's reputation, economic stability, consumer solution, and claims process is vital. By very carefully evaluating these elements, you can pick a home insurance plan that provides the required defense and peace of mind.

Advantages of Reliable Home Insurance Policy

Reliable home insurance coverage provides a feeling of security and defense for house owners versus unpredicted occasions and economic losses. One of the key benefits of reliable home insurance coverage is the assurance that your residential or commercial property will be covered in the occasion of damage or devastation brought on by all-natural catastrophes such as tornados, fires, or floodings. This insurance coverage can aid homeowners stay clear of birthing the complete price of repairs or restoring, supplying tranquility of mind and monetary stability throughout challenging times.

In addition, trustworthy home insurance policy plans frequently include responsibility defense, which can secure home owners from clinical and lawful expenditures in the instance of crashes on their home. This insurance coverage extends beyond the browse around this site physical framework of the home to secure versus legal actions and insurance claims that might emerge from injuries sustained by site visitors.

Furthermore, having reputable home insurance coverage can likewise add to a feeling of total health, understanding that your most significant financial investment is guarded versus various dangers. By paying normal costs, property owners can minimize the possible financial concern of unexpected events, enabling them to concentrate on appreciating their homes without continuous fret about what might happen.

Verdict

To conclude, protecting a dependable home insurance plan is vital for securing your residential or commercial property and valuables from unforeseen occasions. By recognizing the kinds of protection offered, variables that affect costs, and just how to select the ideal policy, you can ensure your comfort. Relying on in a dependable home insurance policy copyright will certainly provide you the benefits of economic defense and safety and security for recommended you read your most useful asset.

Navigating the realm of home insurance coverage can be complex, with different coverage alternatives, policy variables, and factors to consider to consider. Understanding why home insurance coverage is important, the types of insurance coverage readily available, and exactly how to select the appropriate plan can be essential in guaranteeing your most considerable financial investment stays safe.Given the relevance of home insurance coverage in protecting homeowners from unexpected economic losses, it is critical to comprehend the various kinds of insurance coverage readily available to tailor a plan that matches specific demands and situations. San Diego Home Insurance. There are several essential types of coverage offered by most home insurance policies.Picking the appropriate home insurance policy includes careful factor to consider of various vital aspects to ensure comprehensive coverage tailored to private requirements and circumstances

Report this page